Help & FAQ

Help & FAQ

Search

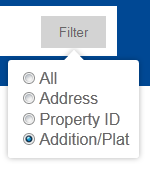

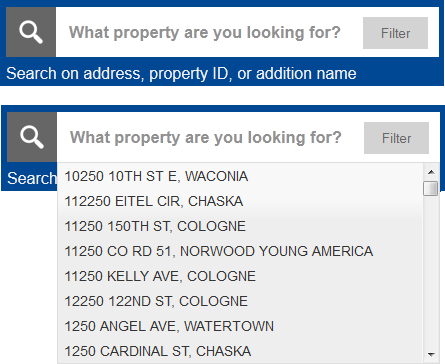

The 'search' bar lets the user search for parcels by address, property ID or addition/plat name. As you are typing, after three characters have been entered, valid suggestions will appear for you to select. Using these suggestions are the recommended way to select a valid property.

Using the filter will limit the results of the suggestions in the search bar. Selecting Addition/Plat will not return addresses or parcel IDs.

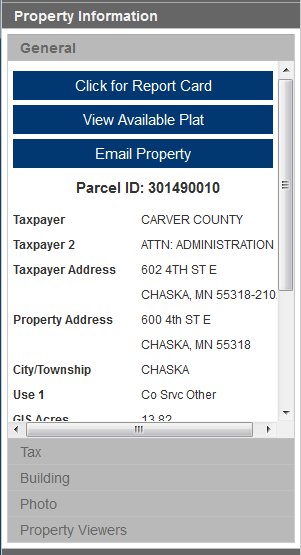

Parcel Information

The property information pane is divided into 5 sections: General, Tax, Building, Photo, and Property Viewers.

General Tab: General information about the property. Taxpayer information and geographic information such as districts and plat (if applicable). From here you will be able to download the property Report Card, which is a summary generated about this property. If a plat is available for this property, a link will be available to view that plat. You can also send someone a link to this particular property.

Tax Tab: Tax related values such as Estimated Land & Building values for the last two tax years. Also available are links to our Tax System to access more information.

Building Tab: General building characteristics for the main building on the property.

Photo Tab: The assessor photo for the building on file

Property Viewers Tab: Links to bird's eye viewer of this property and the imagery viewer at this property.

Additional Tools

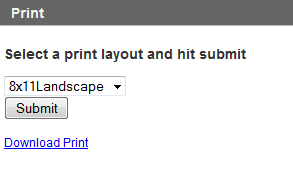

To print the current map, select the print pane. You have the option of 2 layouts: 8.5 x 11 Landscape and Portrait. Select the layout and hit 'Submit'. The print will take a few moments. Once available, click the 'Download Print' button.

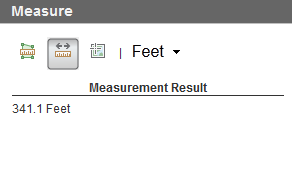

You can measure areas, distances and location. Select a tool and then click on the map. The measurement will display in the 'Measurement Result' section. You can also change which unit the measurement is performed in.

As you turn themes on and off, the legend pane will update to show the current theme.

Frequently Asked Questions

Q: How can I get my property dimensions?

A: If your property is officially platted, you can get your dimensions by clicking the 'View Available Plat' button on the 'General' tab. This will link to the official plat for your property.

Q: My property boundary does not look correct; who can I contact about that?

A: Please contact the Carver County Surveyor's Office:

Q: Can I have access to the data in this application for my own use?

A: Yes, you can access data at our Open Data Portal

Q: I have a property ID number, but it doesn't show up in the Search's suggestions, why?

A: From time to time, a parcel is subdivided, split or combined. When this happens, the original parcel's ID is retired. More than likely, the ID you have has been retired. Try to search by address to determine the new ID.

Q: What is the difference between Mapped Acres, Net Acres and Tax Acres?

A: Tax Acres - Acreage stored in the County's tax system. It may have been derived from deeds or other sources.

Mapped Acres - Calculated acreage of the parcel polygon as mapped and stored in the GIS parcel database. (see Note 1)

Net Acres - The parcel polygon area as mapped and stored in the GIS parcel database less any mapped ROW. (see Note 2)

Notes:

1) The County's GIS parcel database as currently maintained, does not fully account for portions of parcels that are encompassed by right of way; as a result the 'Mapped Acres' acreage is frequently less than a parcels true acreage. Conversely, parcels that are not impacted by right of way, the 'Mapped Acres' may be a good approximation of a parcels total acreage. The ambiguity caused by not knowing which parcels are impacted and which are not without reviewing the subject parcels legal description is a limitation of the Carver County GIS parcel database. The 'Mapped Acres' acreage is not a legal acreage, taxable acreage or any other type of authoritative figure; it is simply the acreage of the polygon that is stored in our system and displayed on our website.

2) “Net acres” is not a legal acreage it is a reference that approximates the parcel area not impacted by right-of-way. Right of way may be acquired in many different ways including dedication, easement, and prescriptive use. For areas where right-of way is prescriptive we have assumed 66’ for mapping purposes, the actual right-of-way may be more or less than 66’.

Q: The text on the report card is unreadable, what can I do?

A: Certain web browsers can have difficulty drawing different fonts. More than likely the actual document (a PDF file) is fine. Save the PDF and open it in a PDF viewer. It should show up in a readable format. Updating to the latest version of your web browser may help reduce these effects as well.

Field Definitions

Click for Report Card - A printed report card of the tax information along with a map of the highlighted parcel

View Available Plat - Links to scanned plat documents if the parcel is platted

Email Property - Email a link to the property

Parcel ID - Carver County unique parcel identification number

Taxpayer – The full first and last name of the property taxpayer

Taxpayer Address – The address of the property taxpayer

Property Address – The physical property address of the property

City/Township – City or Township the parcel resides in

Use 1 – Assessor’s classification use code 1

Use 2 – Assessor’s classification use code 2

Use 3 – Assessor’s classification use code 3

Use 4 – Assessor’s classification use code 4

Acres – The calculated acreage of the highlighted parcel polygon in yellow as seen on the public GIS map. Since 2014, new parcel entries are based on the entire parcel as mapped from a recorded legal description (encompasses road right of way, easements or other interests affecting the property). Earlier mapped parcels excluded right of way and may not be updated. Carver County uses real world coordinates to create polygons as accurate as possible from recorded documents and other available sources. Please note this acreage, in some cases, will not exactly match your private survey data. Always refer to a complete and accurate survey when determining final acreage. Please contact the County Assessor’s Office for taxable acres computed. They often make calculations based on specific parcel conditions.

Last Sale Date – Last known sale in County’s database, dating back to the early 1980’s

Last Sale Price – The sale price of the last sale

Last Sale Qualified/Unqualified – All sales must be reviewed based on criteria developed by the Department of Revenue to determine if the sale will be utilized in the state sale ratio study which is used to measure the quality of each county assessment. Qualified sales are considered good transactions that accurately represent the market. Unqualified sales are sales that are affected by circumstances that could affect the sales price such as sales between relatives or business partners, partial interests, unique financing, forced sales due to legal action, etc.

PLSS – Public Land Survey System – Township, Range, Section

Plat Name – The legal description plat name

Lot – The legal description lot within the block of a plat

Block – The legal description block of a plat

Title Source – How ownership is identified: Abstract, Torrens, or Unknown

Tax Description – The tax legal description of the parcel

School District – The school district the parcel falls within

Watershed District – The watershed district the parcel falls within

---- Estimated Land Value (Payable ----) – Assessed estimated land value for taxes payable the following year

---- Estimated Building Value (Payable ----) – Assessed estimated building value for taxes payable the following year

---- Total Estimated Value (Payable ----) – Assessed estimated total value for taxes payable the following year

Homestead Status – Property is filed as homestead

Green Acres – Agricultural property in the Green Acre program are assessed at an agricultural per acre rate which is set by the Department of Revenue and not the current market rate for that area. The property must be “primarily devoted to agriculture” to qualify and must be under private ownership. Only the acres that are in agricultural production will receive benefit.

Ag Preserve – Agricultural property in the Ag Preserve program are assessed at an agricultural per acre rate which is set by the Department of Revenue and not the current market rate for that area. The property also receives an additional per acre credit on their tax bill. Parcels typically need to be at least 40 acres in size and must be enrolled for a minimum of eight years.

Tax Summary – Link to Taxpayer Services website with detailed tax summary information and tax payment options

Tax Statement – Link to Taxpayer Services tax statement

Year Built – The year the building was built

Building Style – The architecture style of the building

Above Grade Heated Sq. Ft./Total Living Area (TLA) – The total finished heated square footage of the building above grade. Values are based on the ANSI standards to calculate total living area.

Bedrooms – Number of bedrooms within the building

Bathrooms – Number of bathrooms within the building. *Please note that due to a recent CAMA system conversion, the bathroom counts are temporarily unavailable

Garage – Yes/No if a garage is on file for the parcel

Photo – The most recent photo of the front of the house on file from the Assessor's Office